![]() Two-thirds of college seniors graduate with student loan debt, with an average of $26,000 per borrower, according to 2011 data.

Two-thirds of college seniors graduate with student loan debt, with an average of $26,000 per borrower, according to 2011 data.

Making difficult financial decisions, such as whether to apply for student loans, may be a reality for the majority of Thurston County students. The Lacey Branch of Boys & Girls Clubs of Thurston County is helping students prepare for their future by teaching them financial literacy through the Comcast Digital Connectors Program.

Last year, the Lacey Boys & Girls Club won a grant to provide the Comcast Digital Connectors program in the Thurston County area. Comcast created the program to help communities understand the benefits of using broadband internet service.

Last year, the Lacey Boys & Girls Club won a grant to provide the Comcast Digital Connectors program in the Thurston County area. Comcast created the program to help communities understand the benefits of using broadband internet service.

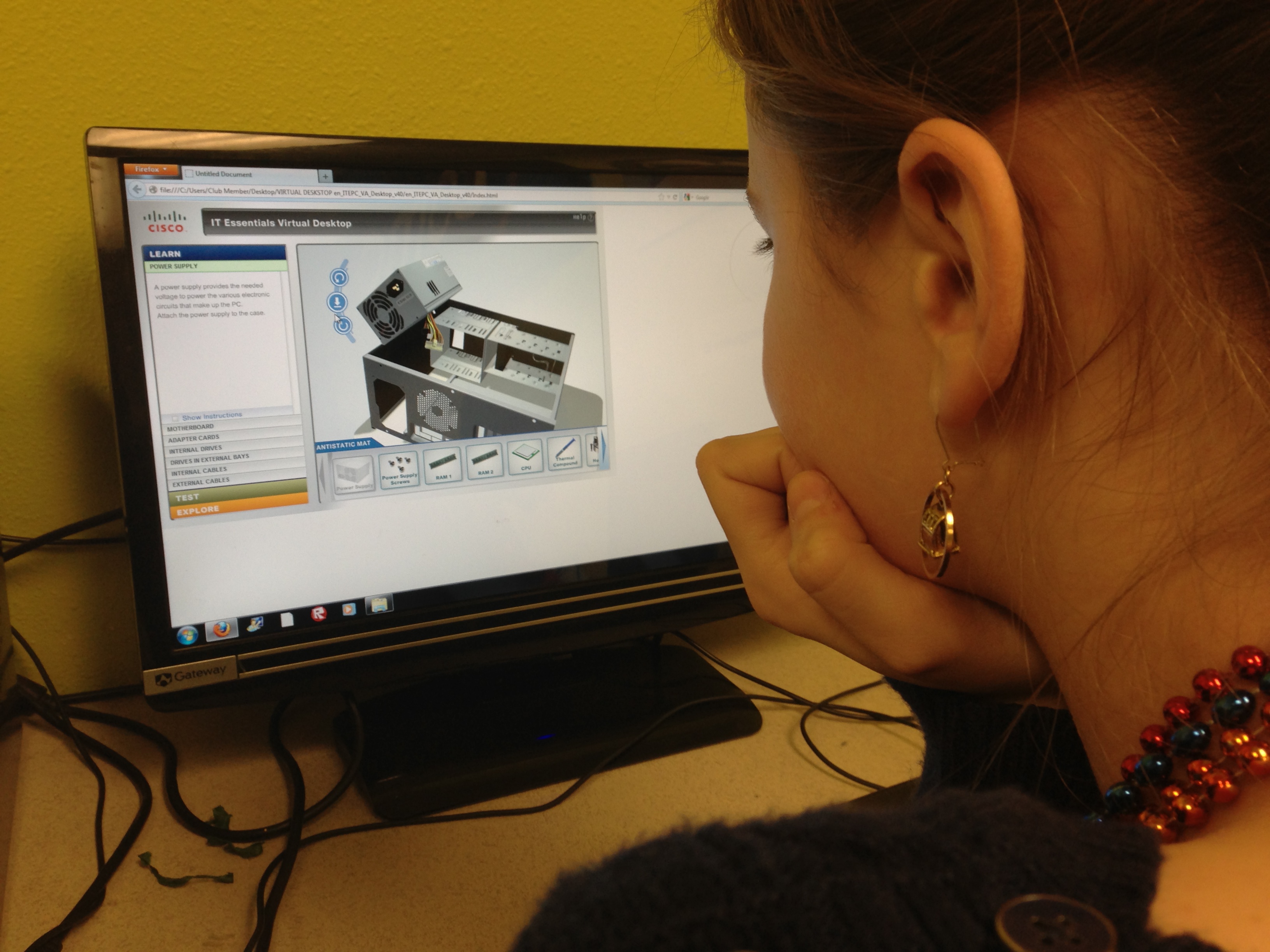

The group of teens, ages 12-16, meets weekly to learn technical skills, broadband technology, digital literacy, software, networks, hardware, and some programming.

The curriculum also provides them with additional skills, such as personal finance and budgeting, skills that inspire educational advancement and workforce preparation. Community service is an important part of the program. The teens commit to provide several hours a month volunteering at community-based organizations, senior centers, churches, and local schools.

The youth, led by instructor Mason Bassett, just finished the financial literacy component of the program. Comcast partnered with EverFi – Financial Literacy™ to provide the curriculum.

EverFi is a new-media learning platform that uses video, animations, 3-D gaming, avatars, and social networking to teach complex financial concepts to youth. In the virtual learning environment kids are able to weigh consequences and choices, and learn to make good financial decisions in a risk-free environment.

The EverFi curriculum covers a variety of topics. Youth learn the importance of maintaining good credit scores, how to purchase insurance, the pros and cons of credit cards, an introduction to taxes investing, savings, retirement plans and mortgages. The curriculum also covers budgeting and the importance of making good financial choices on a daily basis.

The EverFi curriculum covers a variety of topics. Youth learn the importance of maintaining good credit scores, how to purchase insurance, the pros and cons of credit cards, an introduction to taxes investing, savings, retirement plans and mortgages. The curriculum also covers budgeting and the importance of making good financial choices on a daily basis.

“They learn important decision making skills, such as how much to spend on certain portions of their life based on where they are in their lives. They learned that a lot of little purchases will add up quickly if they use credit cards,” said Mason Bassett, the Digital Connectors Instructor at the Lacey Boys & Girls Club.

The kids love the program that is set-up like a video game. “They play out avatars, go through life and make choices. Then they see the results and consequences of their choices. For example, what if your car breaks down? Before that they had the option to save their money or spend it or invest it. If they spent the money and had nothing left in savings, they get to realize they made a bad decision because they had no money set aside to repair their car,” said Bassett.

Boys & Girls Club students earned a certification in financial capability upon completion of the EverFi curriculum, which can be included on resumes and college applications. They also earned badges along the way for mastering key skills.

To learn more about Comcast Digital Connectors contact Shellica Trevino at 438.6811.