Staying in your own home as an aging or disabled citizen becomes more challenging as prices for everything continue to rise. To fall behind with your property taxes is certainly stressful, but then having to sell your house or experience foreclosure is calamitous. The Thurston County Office of the Assessor addresses this issue with the Senior Citizens, Disabled Persons, and Disabled Veterans Property Tax Exemption. People with a limited income can receive a significantly adjusted property tax statement.

The exemption makes a world of difference to many, now and into the future. The upper qualifying limit of household income has increased, making more people eligible. The exemption will freeze the value of the primary residence as of January 1of the qualifying year. It provides a reduction in property taxes and no lien is placed against the property. All excess levies including the state school levy part 2 are exempt. It may also exempt a portion of regular levies. When qualified, adjustment can apply retroactively for up to three years.

Property Tax Help From the Assessor’s Office

It is possible to do the application online. However, you are welcome and even encouraged to come by or make an appointment with one of the friendly team of property control analysts. For some, it’s a quick 15 minutes at the counter. Some people’s circumstances are easy to sort out. With proper paperwork not only will the homeowner receive an exemption but may qualify for the prior three years. The Office of the Treasurer is in the same building on Pacific Avenue, and that office is a regular referral service to those who may qualify.

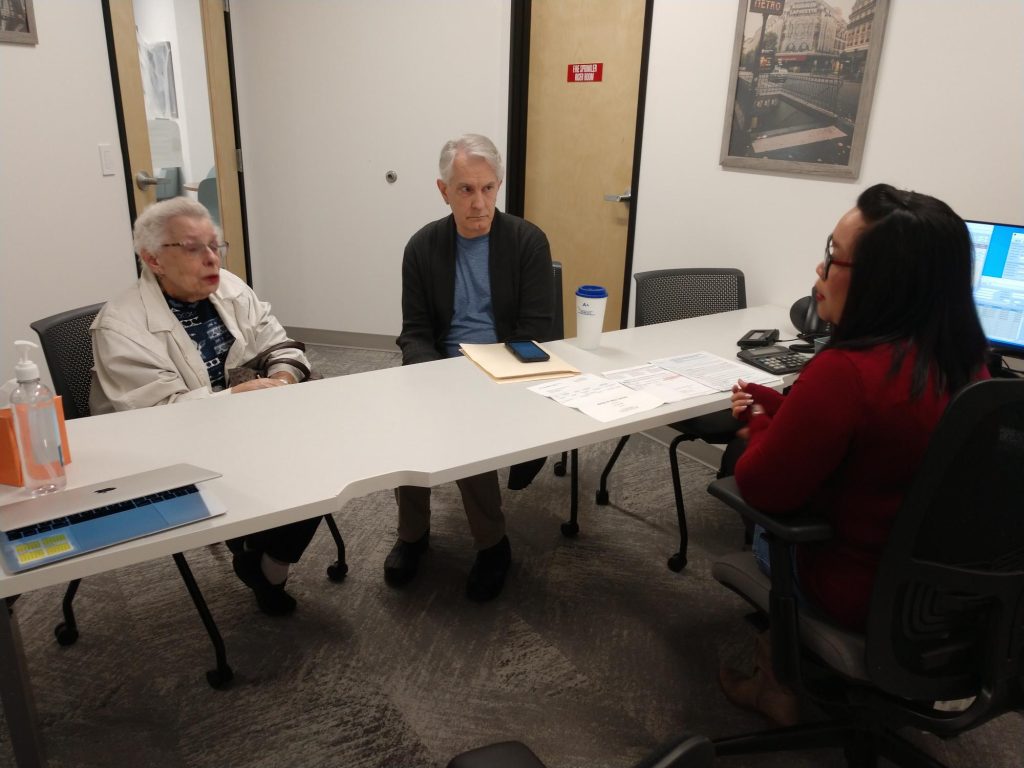

Some people’s circumstances are more complicated and entail more paperwork. There are private, windowed offices with tables for customers to work with a team member. Property owners can bring a friend for assistance, and family members may accompany their parents.

Michelle Jimenea is one of the property control analysts. “A lot of people have just lost a spouse or are in a difficult circumstance,” she says. “It’s really hard. We want to help as much as possible.”

The sentiments are similar from Angie Hill, the senior property control analyst and exemption specialist. “People are so grateful. Sometimes they start to cry,” she says. There’s a box of tissues on the table, which comes in handy.

“If we don’t know an answer about the finances, we will call DOR (Department of Revenue),” says Property Administration Manager Cyndi Ross. “Our aim is to get them in the program with the best exemption we can.”

Eligibility Requirements for County Property Tax Exemption

1. Age or Disability must meet at least one of the following:

- 61 years or older.

- Disabled and unable to pursue gainful employment.

- Veteran with an 80% or greater Service Connected Disability Rating.

2. Own and occupy the property more than six months of the calendar year.

3. Total household income of $59,000 or less.

Income and Expenses that Matter for Property Tax Exemptions

It is noteworthy that the Legislature raised the income level from $48,566 up to $59,000. The income is your gross or total income, which includes social security, pensions, IRA distributions, rental income and any employment. Homeowners expenses can be subtracted from the total income. “There are new deductions. Someone may have $60,000 worth of nursing care,” Cyndi explains. That means even a significant income of $100,000 could still qualify.

Allowable Deductions

- Non-reimbursed amounts paid for prescription drugs.

- Premiums for Medicare Parts A, B, C & D.

- Non-reimbursed amounts paid for care in a nursing home, assisted living facility, or adult family home.

- Non-reimbursed amounts paid for in-home care, including medical treatments, physical therapy, meal delivery service, personal care and household care.

- It is also possible to deduct for special furniture or equipment such as wheelchairs, hospital beds and oxygen.

There are newer deductions for long-term care premiums, prosthetic devices, insulin, and medicine prescribed, administered, and dispensed when under the treatment of a Washington State licensed naturopath.

Documents You Need for Tax Exemption

- A completed and signed application with Combined Disposable Income Worksheet

- A copy of your current Washington State ID or driver’s license

- Proof of Disability, if under 61:

- Social Security Award Letter

- Proof of Disability Statement completed by a licensed physician

- VA Award letter or Benefit Verification Letter

- Income documentation like an IRS Tax Return (1040)

- Receipts or documentation for deductions

“It’s a fulfilling feeling to help people stay in their homes, says Buddy Stevens, a property control analyst for the past three years. The thought of applying might be intimidating for many. “You don’t have to figure it out online. I would encourage you to call,” suggests Cyndi. You can also get a brochure sent to you. Get more information on the Thurston County Assessor’s website for yourself and then pass it along to someone you know who may qualify.

Office of the Assessor

3000 Pacific Avenue, Olympia

360.867.2200